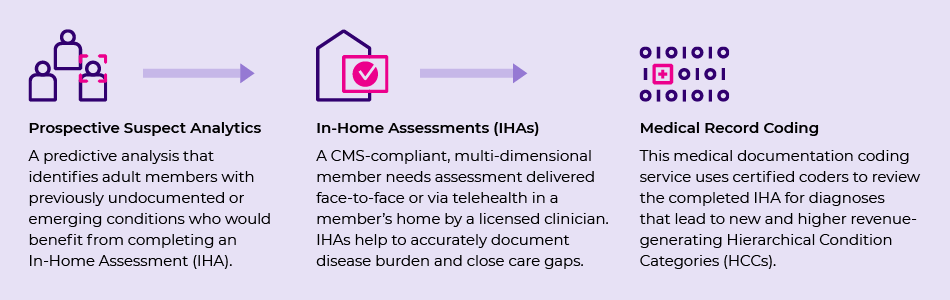

As we highlighted, deferred care has increased sizably during the COVID-19 pandemic, making it more difficult for health plans to document their members’ disease burden and coordinate care.

Read our fact sheet to learn how Cotiviti’s Prospective Risk Adjustment solutions address this challenge by providing health plans with the necessary insights to close gaps in care and enable proactive interventions.

Key benefits include:

A growing number of strategic payer initiatives, such as value-based care, intersect both risk adjustment and quality improvement programs. Watch our on-demand panel discussion featuring Cotiviti and PopHealthCare as we discuss how new trends in telehealth utilization, in-home assessments, and Star Ratings can influence both risk and quality programs-—and how this impacts health plans as they set future strategies.

Using in-home health risk assessment (IHA) programs to identify risk is only part of the equation. Once risks are identified, mitigation strategies must be in place to ensure patients receive high-value care.

This presentation will help health plans navigate the important distinction between risk identification and mitigation, drawing on Cotiviti’s analysis of IHAs and subsequent provider encounters. Attend our session with Fallon Health to:

Stacy Coggeshall

Vice President, Risk Adjustment, Fallon Health

David Costello, Ph.D.

Senior Vice President, Risk Adjustment and Innovation, Cotiviti

A growing number of strategic payer initiatives, such as value-based care, intersect both risk adjustment and quality improvement programs. Join leaders from Cotiviti and PopHealthCare as they discuss how new trends in telehealth utilization, in-home assessments, and Star Ratings can influence both risk and quality programs—and how this impacts health plans as they set future strategies.

The 30-minute panel discussion will be followed by a brief Q&A.

Arturo Diaz

Chief Operations Officer, Risk Adjustment, PopHealthCare

Rachael Jones

Senior Vice President, Performance Analytics and Quality, Cotiviti

David Costello, Ph.D.

Senior Vice President, Risk Adjustment and Innovation, Cotiviti